In recognition of his outstanding contributions to humanitarian efforts, Huseyin Erten has been honored for his pivotal work with the Coalition of Hope

Read MoreGATEWAY TO US CAPITAL MARKETS

Financial Architecture Specialists

Strategic Advisory

US CAPITAL INVESTMENTS GROUP

About

Leveraging a sophisticated risk architecture, USCI, in concert with its affiliate networks, strategic alliances, and licensed financial partners, adeptly transforms commercial and project risks into institutional-grade credit risks. This transformation, a hallmark of post-2008 financial innovation, facilitates the creation of asset classes at an institutional caliber, thereby augmenting the landscape of investment opportunities.

With privileged access to the institutional capital markets of the United States, through strategic relationships, USCI is adept at mobilizing financial resources for a diverse array of transactions, technological initiatives, and infrastructure projects across select jurisdictions. The capability to source comprehensive capital solutions, whether singularly or through a consortium, is underscored by streamlined, predefined processes that enhance the efficiency of liquidity provision across our extensive broker-dealer and investment banking network.

Moreover, USCI distinguishes itself not merely as a conduit for capital but as an active participant in its ventures. Through development partnerships and sponsorship roles, USCI undertakes direct investment, subjecting projects to rigorous vetting and underwriting processes grounded in proprietary credit scoring methodologies to ensure compliance with institutional standards.

The consortium under the auspices of US Capital Investment (USCI) is predicated upon a hybrid business model that encompasses both investment and commercial banking paradigms. This consortium is distinguished by the inclusion of an entity that is duly licensed and regulated within the ambit of the Commission de Surveillance du Secteur Financier (CSSF) of Luxembourg, thus aligning with the stringent regulatory prerequisites mandated by the CSSF.

In its endeavor to deliver financial services that are both enriching and of substantive value, USCI extends its expertise to a diverse clientele that includes sovereign entities, financial institutions, banking entities, as well as developers operating within both the public and private sectors. This strategic approach enables USCI to fulfill its mission of bridging US Capital Markets with Emerging Market Economies through a sophisticated array of services designed to facilitate the deployment of US institutional capital across a global landscape

USCI's unique amalgamation of investment and commercial banking prowess, alongside its proficiency in structured finance, crafts a robust funding paradigm that transcends traditional public and private sector financing avenues. This multifaceted approach, enriched by our innovative financial architecture and strategic foresight, enables the creation of bespoke, pioneering solutions that address the nuanced requirements of our clientele.

At its core, the USCI consortium thrives on the synergy of its multinational professionals, whose collective expertise spans over a century in specialized financing, international banking, and the orchestration of complex financial structures. This deep well of knowledge encompasses a wide spectrum of financial instruments, including but not limited to debt, equity, hybrid forms, Sukuk, and other structures compliant with specific regulatory frameworks and Islamic financial principles.

In essence, USCI stands as a testament to the power of innovative finance, bridging worlds, and creating opportunities through strategic vision, unparalleled expertise, and a commitment to fostering economic growth and prosperity on a global scale

Mission

By leveraging the prowess of US corporations, the innovation of US technologies, and the depth of the US Capital Markets, we endeavor to introduce these resources into emerging markets. Our strategy involves the meticulous structuring of projects in compliance with institutional capital requirements, thereby empowering entities in foreign markets to access the expansive capital resources available within the USA.

We hold the conviction that robust business engagements serve as the cornerstone of effective diplomacy, paving the way for enduring, sustainable partnerships and alliances. Our commitment is to nurturing these relationships through strategic and thoughtful business initiatives.

`Good Business brings Good Diplomacy `

H. Burak Erten

Modus Operandi

USCI functions as a comprehensive advisory platform, encompassing a consortium of group entities actively engaged in facilitating transactions, overseeing strategic affiliations, and amalgamating premier business practices and methodologies to champion US excellence and innovation, the prowess of US Capital Markets, and the global proliferation of US businesses.

Our Values

The leadership at USCI places paramount importance on institutionalism, transparency, and strategic foresight, staunchly upholding the core values of the United States. They accord substantial significance to the principles of honesty, integrity, and fairness in all their commercial engagements.

Activities

The company addresses horizontal and sector-specific markets, leveraging proprietary solutions designed to deliver unique value to specific business areas.

Focuses

USCI focuses on Infrastructure, Energy & Renewables, Real Estate, Private Bilateral Initiatives, Proprietary Fund designs based on unique financial architecture, creation of unique economic structures aimed at deployment of liquidity to Real Economy, Corporate and Non-Performing Loans and Nation Building Strategies

Expertise

The leadership of USCI has a combined 120 plus years of C-level experience, having involved with multinational corporations, cross-border transactions, advisory roles of sovereigns and sub-sovereigns, and complex transaction structuring. The core areas of expertise are as follows :

Financial Architecture - designing and implementing.

Transaction and credit structuring

Securitization and De-Risking

Underwriting

Strategic Introductions and alliances

International economic cooperation, trade, and foreign direct investment.

Government Economic Policy Development

Nation Building Programs

Advisory on Strategic Security Issues

Global Presence

USCI boasts an extensive global network, comprising strategic partners, associates, solution collaborators, brokers, and introducers across over 50 countries worldwide. This formidable alliance facilitates a collective in-house expertise, encompassing more than 50 seasoned advisors and executives at the C-suite level, thereby enhancing USCI's professional bandwidth and operational capacity

Engagement.

USCI undertakes engagements exclusively with a discerning clientele and transactions, wherein references and formal introductions are pivotal to its selection criteria. It steadfastly refrains from affiliating with clients entangled in transactions with entities adversarial to the United States of America. Each scenario or project is approached with bespoke consideration, often necessitating intricate structuring to devise appropriate solutions. Consequently, USCI anticipates a sophisticated level of interaction and understanding from its clients in all dealings.

Compliance - Geostrategy

USCI conducts its operations in strict adherence to the compliance regulations stipulated by FATCA, OFAC, and CAATSA, while aligning its practices with the guidelines and objectives set forth in the National Security Strategy Publication. This meticulous observance ensures that USCI's activities are conducted within the framework of national and international regulatory standards, reflecting its commitment to upholding the highest standards of legal and ethical conduct..

Leadership

H. Burak Erten

President

Mr. H. Burak Erten ( www.burakerten.us ) is the President of US Capital Investments Group, focusing on advisory for the deployment of institutional capital aligned with US interests. Mr. Erten is a fund manager in Luxembourg (authorized by CSSF) and in Malta ( authorized by MFSA ) and

Clinton G. Bryan

Chief Executive Officer

Clinton Bryan is the Chief Executive Officer of the group. Clinton is a decorated Military Combat Veteran with over 28 years of combined experience in the U.S. Naval Construction Force Seabees and the civilian construction sector.

Derrick M. Comfort

Group Chairman- Governments

Derrick Comfort is a true American patriot, US Army veteran with 45 years of experience in international banking and business development and execution in more than 50 countries globally. Derrick has held strategic initiatives and discussions held with various governments and is the VisionAire for Zero Waste Park concept

Sohail S. Quraeshi

Executive Board Member

A graduate of Buckingham University (L.Sc Econ) UK, Mr. Quraeshi started his career with the Bank of New England in Boston as a Security Analyst following a diverse group of industries including Telecom and Consumer Electronics. After 6 years he became private banker and advisor for the Aquino family of the Philippines.

Mark Kraselsky

Executive Board Member-Industries

Mark has spent the last three decades expanding the design, manufacture, and sales of groundbreaking custom branded products to the hospitality industry. His success originates from his business expertise and innovative industrial design.

Services

Associated Firms

- COH FOUNDATION INC www.coalitionofhope.org

- Q Group www.qgroup.capital

- QFTF www.qftf.fund

- QI-AM www.qi-am.eu

- Bastion Wealth www.bastionwealth.net

- CTEP www.theatlanticpartnership.org

- New Century Funds www.newcenturyfunds.com

Blog

Huseyin Burak Erten has been included in Marquis Who's Who. As in all Marquis Who's Who biographical volumes, individuals profiled are selected on the basis of current reference value

Read MoreDiscover the Power of Prosperity Bonds: A Call to Action for the G7 Unlock the potential of innovative financial solutions with "Prosperity Bonds Agency - A Call to Action to G7"

Read MoreDiscover How to Transform Your Ideas into Investment-Worthy Ventures Step into a realm where the complexities of finance become your stepping stones to success.

Read MoreDiscover the Secrets of Financial Mastery with Expert Insight into Wall Street’s Complex World Embark on an illuminating journey through the intricate landscape of finance

Read MoreDiscover the Secrets of European Finance with Our Expert Guide Imagine having a roadmap to the heart of Europe's financial hub,

Read MoreDiscover the Financial Blueprint to Empower Your Project's Success Immerse yourself in the vital resource that is "Unlocking Capital: The Power of Bonds in Project Finance

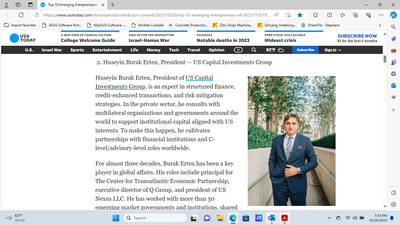

Read MoreHuseyin Burak Erten, President of US Capital Investments Group, has been recognized as one of the Top 10 Emerging Entrepreneurs of 2023 by USA Today

Read MoreDiscover the influence and significance of Mr. H. Burak Erten's recognition in the prestigious Top100 Magazine for Finance Professionals. Explore how this achievement highlights his expertise and contributions to the finance industry.

Read MoreMr. Erten has been featured on the The CIO Today magazine as ` Highly Acclaimed , The 5 Most Innovative Entrepreneurs to Watch in 2023

Read MoreContact

- Tampa, FL, USA

- Washington DC, Miami , Tampa, Luxembourg, Malta

- us@uscapital.eu

- Mon-Fri - 09:00-18:00

US NEXUS LLC US CAPITAL INVESTMENTS LLC US INSTITUTIONAL CAPITAL INVESTMENTS LLC 401 East Jackson Street, Suite 2340 , Tampa, FL, T: +1 941 491 2023 F: +1 941 491 2024